Wednesday, June 2, 2021

Just Listed 1008 E 31st Street, Mission, Texas

🌐 Follow this link for more info : https://bit.ly/3ySOzjo

🚨 JUST LISTED 🚨

1008 E 31st Street, Mission, Texas 78574

What’s Motivating People To Move Right Now?

What’s Motivating People To Move Right Now?

This year, Americans are moving for a variety of reasons. The health crisis has truly reshaped our lifestyles and our needs. Spending so much more time in our current homes has driven many people to reconsider what homeownership means and what they find most valuable in their living spaces.

According to the 2020 Annual National Movers Study:

“For customers who cited COVID-19 as an influence on their move in 2020, the top reasons associated with COVID-19 were concerns for personal and family health and wellbeing (60%); desires to be closer to family (59%); 57% moved due to changes in employment status or work arrangement (including the ability to work remotely); and 53% desired a lifestyle change or improvement of quality of life.”

With a new perspective on homeownership, here are some of the reasons people are reconsidering where they live and making moves right now.

1. Working from Home

Remote work became the new norm, and for some, it’s persisting longer than initially expected. Many in the workforce today are discovering they don’t need to live so close to the office anymore and they can get more for their money if they move a little further outside the city limits. Apartment List notes:

“The COVID pandemic has sparked a rebound in residential migration: survey data suggest that 16 percent of American workers moved between April 2020 and April 2021, up from 14 percent in 2019 and the first increase in migration in over a decade… One of the major drivers in this trend is remote work, which expanded greatly in response to COVID and will remain prevalent even after the pandemic wanes. No longer tethered to a physical job site, remote workers were 53 percent more likely to move this past year than on-site workers.”

If you’ve tried to convert your guest room or your dining room into a home office with minimal success, it may be time to find a larger home. The reality is, your current house may not be optimally designed for this kind of space, making remote work very challenging.

2. Room for Fitness & Activities

Staying healthy and active is a top priority for many Americans, and dreams of having space for a home gym are growing stronger. A recent survey of 4,538 active adults from 122 countries noted the three fastest-growing fitness trends amongst active adults:

- At-home fitness equipment (up 50%)

- Personal trainers/nutritionists (up 48%)

- Online fitness courses, classes, and subscriptions (up 17%)

Having room to maintain a healthy lifestyle at home – physically and mentally – may prompt you to consider a new place to live that includes space for at-home workouts, hobbies, and activities for your household.

3. Outdoor Space

Better Homes & Gardens recently released the outdoor living trends for this year, and three of them are:

- Outdoor Kitchens: 60% of homeowners are looking to add outdoor kitchens.

- Edible Garden: Millions of people began gardening during the pandemic . . . to supplement pantries with homegrown fruits, vegetables, and herbs.

- Secluded Spaces: As outdoor activity increases, so does the need for privacy.

You may not, however, currently have the space you need for these designated areas – inside or out.

Bottom Line

If you’re clamoring for more room to accommodate your changing needs, making a move may be your best bet, especially while you can take advantage of today’s low mortgage rates. It’s a great time to get more home for your money, just when you need it most.

Boat in South Padre Island Texas

Jinks Realty 📷Photo for Today: Boat in South Padre Island Texas📍 - View Properties in South Padre Island Texas and the Rio Grande Valley of South Texas at: www.JinksRealty.com or Call ☎️(956) 429-3232

⭐️⭐️🅱🅾🅽🆄🆂 ⭐️⭐️ LIKE the 📷photos on our page❤️

Then Follow us on:

Facebook: @JinksRealty

Instagram: @jinksrealty

Wishing Everyone a Safe and Happy Memorial Day!

Jinks Realty is Wishing Everyone a Safe and Happy Memorial Day!

Jinks Realty is Wishing Everyone a Safe and Happy Memorial Day!

Jinks Realty is Wishing Everyone a Safe and Happy Memorial Day!

Please Thank Every US 🎖️Military Men & Women For Their Sacrifices & Services.

Thursday, May 27, 2021

How Misunderstandings about Affordability Could Cost You

How Misunderstandings about Affordability Could Cost You

There’s a lot of discussion about affordability as home prices continue to appreciate rapidly. Even though the most recent index on affordability from the National Association of Realtors (NAR) shows homes are more affordable today than the historical average, some still have concerns about whether or not it’s truly affordable to buy a home right now.

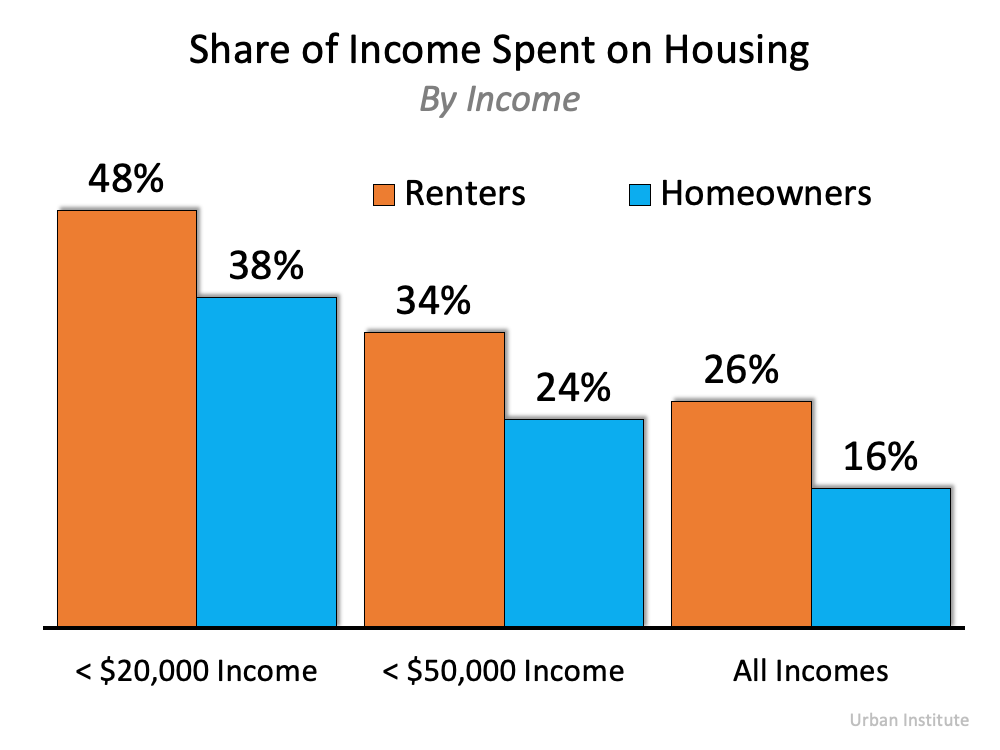

When addressing this topic, there are various measures of affordability to consider. However, very few of the indexes compare the affordability of owning a home to renting one. In a paper just published by the Urban Institute, Homeownership Is Affordable Housing, author Mike Loftin examines whether it’s more affordable to buy or rent. Here are some of the highlights included.

1. Renters pay a higher percentage of their income toward their rental payment than homeowners pay toward their mortgage.

The report explains:

“When we look at the median housing expense ratio of all households, the typical homeowner household spends 16 percent of its income on housing while the typical renter household spends 26 percent. This is true, you might say, because people who own their own home must make more money than people who rent. But if we control for income, it is still more affordable to own a home than to rent housing, on average.”

Here’s the data from the report shown in a graph:

2. Renters don’t have extra money to invest in other assets.

The report goes on to say:

“Buying a home is not a decision between investing in real estate versus investing in stocks, as financial advisers often claim. Instead, the home buying investment simply converts some portion of an existing expense (renting) into an investment in real estate.”

It explains that you still have a housing expense (rent payments) even if you don’t buy a home. You can’t live in your 401K, but you can transfer housing expenses to your real estate investment. A mortgage payment is forced savings; it goes toward building equity you will likely get back when you sell your home. There’s no return on your rent payments.

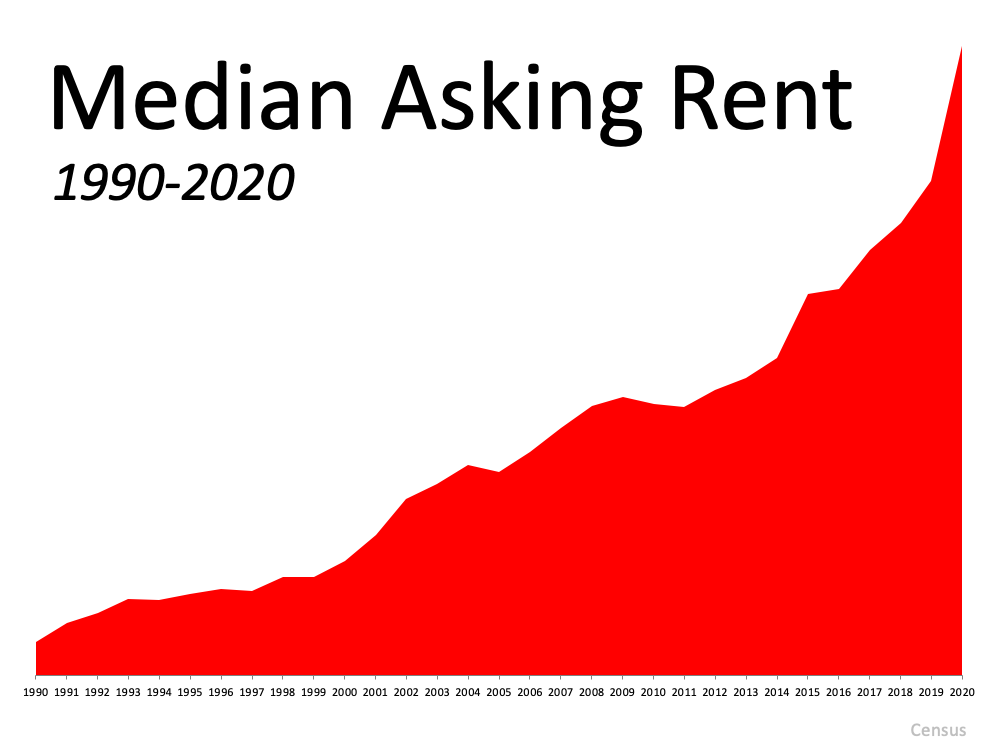

3. Your mortgage payment remains relatively the same over time. Your rent keeps going up.

The report also notes:

“Whereas renters are continuously vulnerable to cost increases, rising home prices do not affect homeowners. Nobody rebuys the same home every year. For the homeowner with a fixed-rate mortgage, monthly payments increase only if property taxes and property insurance costs increase. The principal and interest portion of the payment, the largest portion, is fixed. Meanwhile, the renter’s entire payment is subject to inflation.

Consequently, over time, the homeowner’s and renter’s differing trajectories produce starkly different economic outcomes. Homeownership’s major affordability benefit is that it stabilizes what is likely the homeowner’s biggest monthly expense, assuming a buyer has a fixed-rate mortgage, which most American homeowners do. The only portion of the homeowner’s housing expenses that can increase is taxes and insurance. The principal and interest portion stays the same for 30 years.”

A mortgage payment remains about the same over the 30 years of the mortgage. Here’s what rents have done over the last 30 years:

4. If you want to own a home and can afford it, waiting could cost you.

As the report also indicates:

“We need to stop seeing housing as a reward for financial success and instead see it as a critical tool that can facilitate financial success. Affordable homeownership is not the capstone of economic well-being; it is the cornerstone.”

Homeownership is the first rung on the ladder of financial success for most households, as their home is most often their largest asset.

Bottom Line

If the current headlines reporting a supposed drop-off in home affordability are making you nervous, let’s connect to go over the real insights into our area.