Thursday, June 10, 2021

ELON are You Looking for SPACE?

ELON MUSK are You Looking for SPACE?

Call me Erika Ramirez REALTOR with JINKS REALTY (956) 532-5527 to find you that SPACE!

This Is Not Like 2008 Again

Why This Is Not Like 2008 Again

During the Great Recession, just over a decade ago, the financial systems the world depended on started to collapse. It created a panic that drove some large companies out of business (ex. Lehman Brothers) and many more into bankruptcy.

The financial crisis that accompanied the current pandemic caused hardship to certain industries and hurt many small businesses. However, it hasn’t rattled the world economy. It seems that a year later, things are slowly getting back to normal for many companies.

Why is there a drastic difference between 2008 and now?

In a post from RealtyTrac, they explain:

“We changed the rules. We told banks they needed more reserves and that they could no longer underwrite toxic mortgages. It turns out that regulation — properly done — can help us navigate financial minefields.”

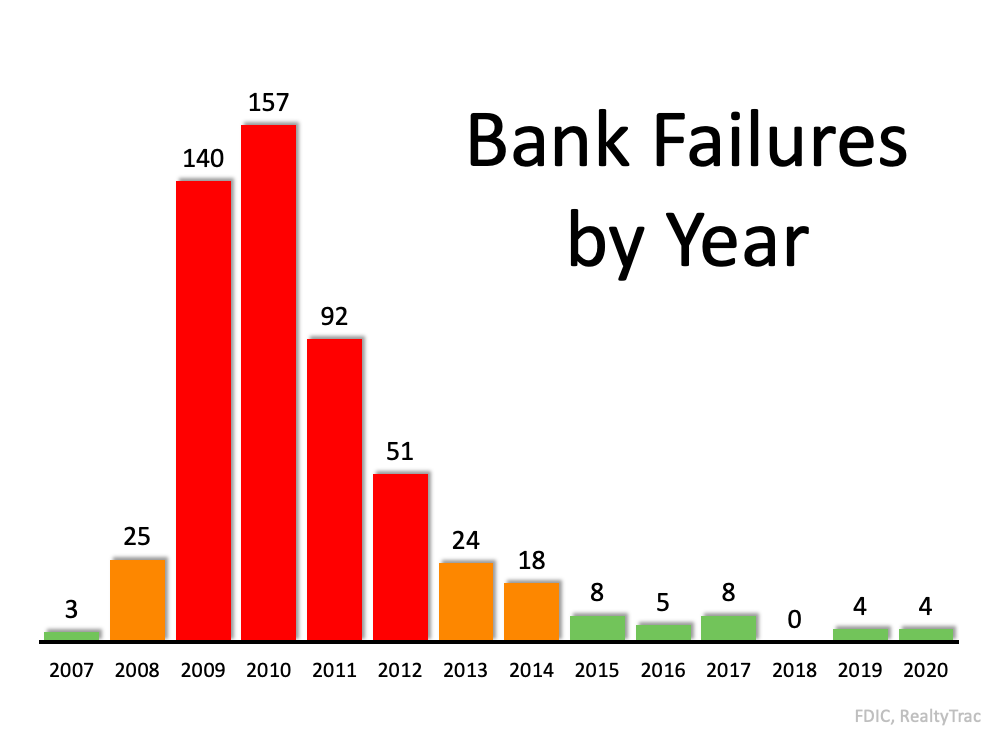

Here are the results of that regulation, captured in a graph depicting the number of failed banks since 2007.

What was different this time?

The post mentioned above explains:

“In 2008 the government saw the foreclosure meltdown as a top-down problem and set aside $700 billion for banks under the Troubled Asset Relief Program (TARP). Not all of the $700 billion was used, but the important point is that the government did not act with equal fervor to help flailing homeowners, millions of whom lost their homes to foreclosures and short sales.

This time around the government forcefully moved to help ordinary citizens. Working from the bottom-up, an estimated $5.3 trillion went to the public in 2020 through such mechanisms as the Paycheck Protection Program (PPP), expanded unemployment benefits, tax incentives, and help for local governments. So far this year we have the $1.9 billion American Rescue Plan with millions of $1,400 checks as well as proposals to spend trillions more on infrastructure…Bank deposits increased by nearly $2 trillion during the past year and credit card debt fell.”

Bottom Line

Many have suffered over the past year. However, the economic toll of the current recession was nowhere near the scope of the Great Recession, and it won’t result in a housing crisis.

Wednesday, June 9, 2021

Happy Birthday Kyle Adams

JINKS REALTY would like to wish Kyle Adams a Happy Birthday🎂! May God Bless You and Your Family Everyday!

Unknown Bird in Edinburg Texas

Jinks Realty 📷Photo for Today: Unknown Bird in Edinburg Texas📍 - View Properties in Edinburg Texas and the Rio Grande Valley of South Texas at: www.JinksRealty.com or Call ☎️(956) 429-3232

⭐️⭐️🅱🅾🅽🆄🆂 ⭐️⭐️ LIKE the 📷photos on our page❤️

Then Follow us on:

Facebook: @JinksRealty

Instagram: @jinksrealty

Home Price Appreciation Is as Simple as Supply and Demand

Home Price Appreciation Is as Simple as Supply and Demand

Home price appreciation continues to accelerate. Today, prices are driven by the simple concept of supply and demand. Pricing of any item is determined by how many items are available compared to how many people want to buy that item. As a result, the strong year-over-year home price appreciation is simple to explain. The demand for housing is up while the supply of homes for sale hovers at historic lows.

Let’s use three maps to show how this theory continues to affect the residential real estate market.

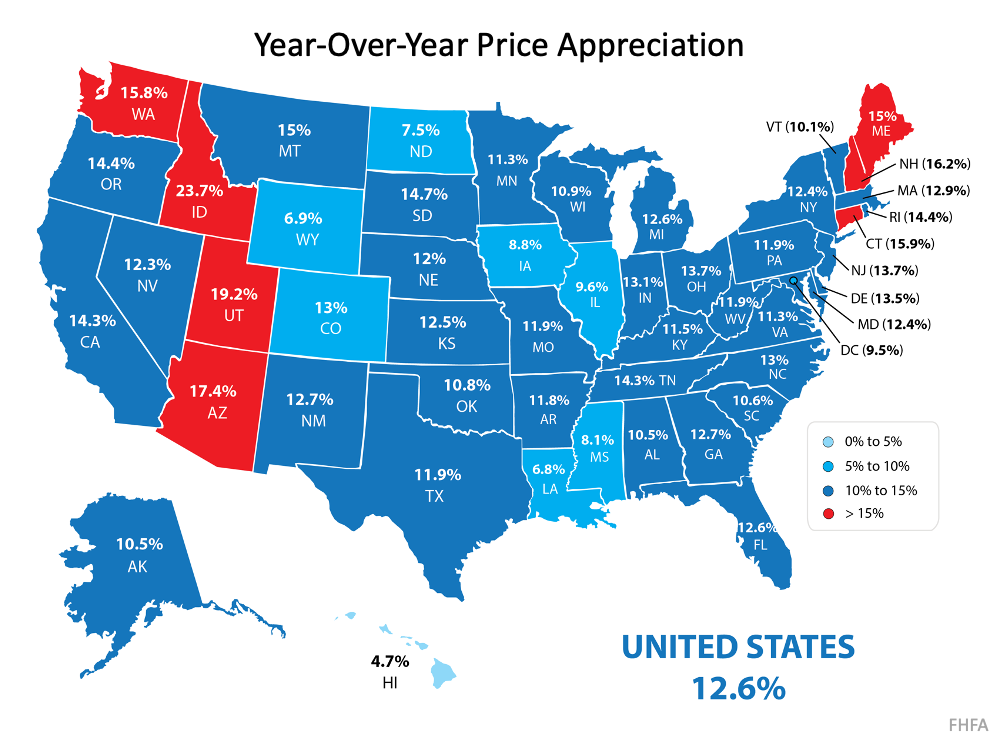

Map #1 – State-by-state price appreciation reported by the Federal Housing Finance Agency (FHFA) for the first quarter of 2021 compared to the first quarter of 2020: As the map shows, certain states (colored in red) have appreciated well above the national average of 12.6%.

As the map shows, certain states (colored in red) have appreciated well above the national average of 12.6%.

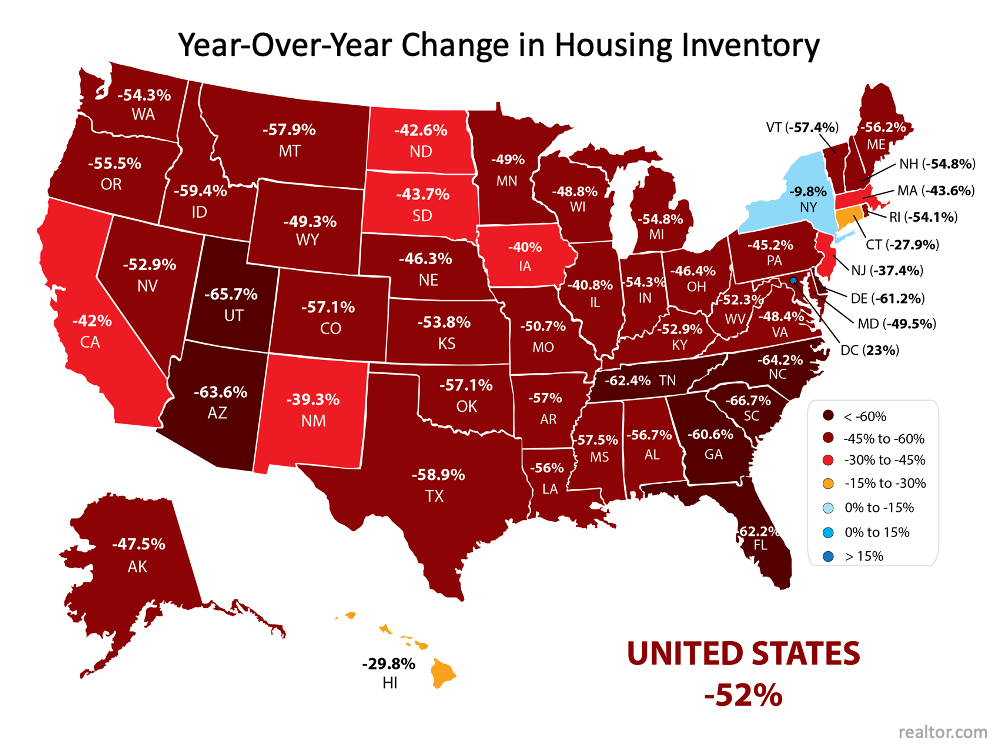

Map #2 – The change in state-by-state inventory levels year-over-year reported by realtor.com: Comparing the two maps shows a correlation between change in listing inventory and price appreciation in many states. The best examples are Idaho, Utah, and Arizona. Though the correlation is not as easy to see in every state, the overall picture is one of causation.

Comparing the two maps shows a correlation between change in listing inventory and price appreciation in many states. The best examples are Idaho, Utah, and Arizona. Though the correlation is not as easy to see in every state, the overall picture is one of causation.

The reason prices continue to accelerate is that housing inventory is still at all-time lows while demand remains high. However, this may be changing.

Is there relief around the corner?

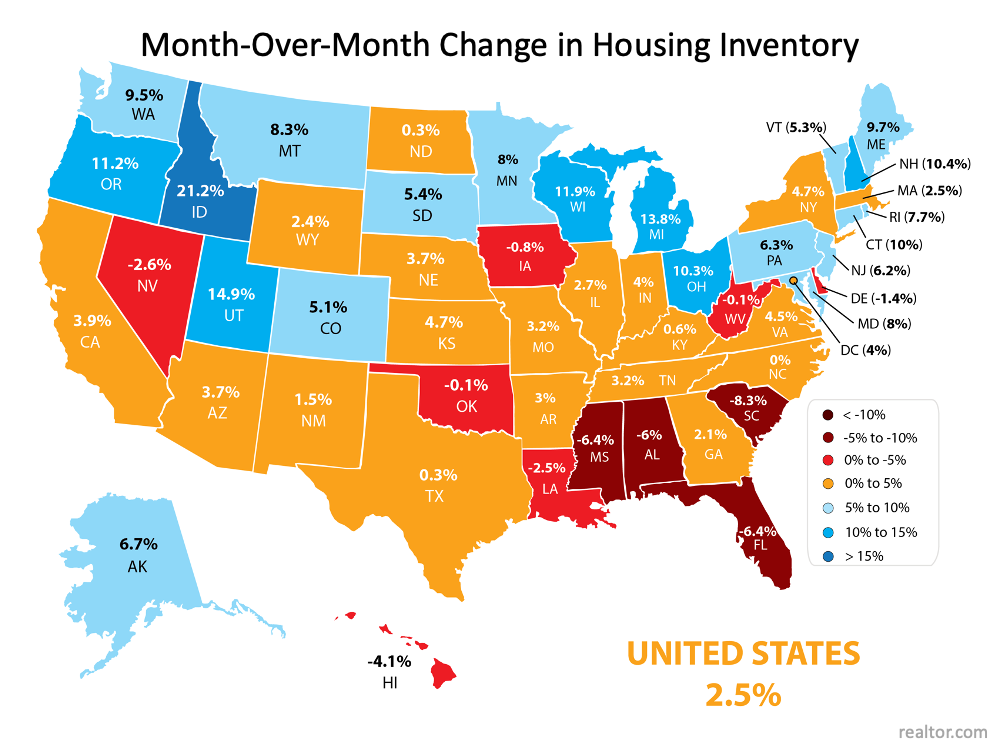

The report by realtor.com also shows the monthly change in inventory for each state.

Map #3 – State-by-state changes in inventory levels month-over-month reported by realtor.com: As the map indicates, 39 of the 50 states (plus the District of Columbia) saw increases in inventory over the last month. This may be evidence that homeowners who have been afraid to let buyers in their homes during the pandemic are now putting their houses on the market.

As the map indicates, 39 of the 50 states (plus the District of Columbia) saw increases in inventory over the last month. This may be evidence that homeowners who have been afraid to let buyers in their homes during the pandemic are now putting their houses on the market.

We’ll know for certain as we move through the rest of the year.

Bottom Line

Some are concerned by the rapid price appreciation we’ve experienced over the last year. The maps above show that the increases were warranted based on great demand and limited supply. Going forward, if the number of homes for sale better aligns with demand, price appreciation will moderate to more historical levels.

Tuesday, June 8, 2021

Choose Don Pepe's 🆚 Delia's

Choose for Yoli B. Gonzalez

Don Pepe's 🆚 Delia's

J

I

N

K

S

R

E

A

L

T

Y

We Have Mission Texas Homes for Sale , RGV Rio Grande Valley Real Estate Properties, Land, See our Listings for Residential & Commercial Real Estate listings in McAllen, Edinburg, Sharyland, Mission, San Juan, Alamo, Weslaco, Pharr, & Hidalgo County, Texas

#texas #southtexas #riograndevalley #jinksrealty #mcallentx #edinburgtx #weslacotx #realestate #homes #rgv #bienesraices #missiontx #realtor #realtorlife #pharr #missiontx #home #dreamhome #selling #listing #homesearch #realty #forsalemcallen #mcallenrealestate #texasrealtor #property #rgvrealestate

Bird in Edinburg Texas

Jinks Realty 📷Photo for Today: Bird in Edinburg Texas📍 - View Properties in Edinburg Texas and the Rio Grande Valley of South Texas at: www.JinksRealty.com or Call ☎️(956) 429-3232

⭐️⭐️🅱🅾🅽🆄🆂 ⭐️⭐️ LIKE the 📷photos on our page❤️

Then Follow us on:

Facebook: @JinksRealty

Instagram: @jinksrealty